Choosing the Best Forex Options Brokers

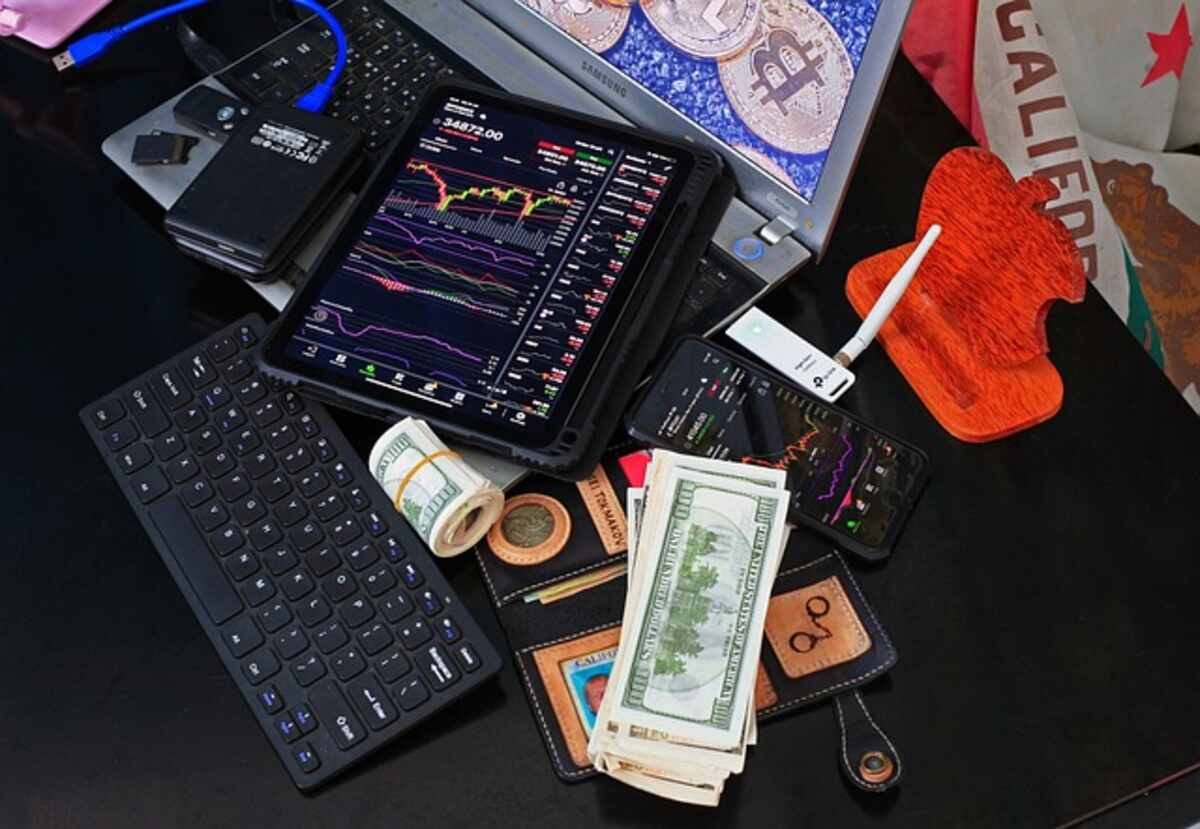

Forex options are derivative contracts that give traders the right (but not the obligation) to purchase or sell currencies at a specified price on a specified date. They are a great way to speculate and hedge against future movements in currency exchange rates. Check out the Best info about forex robot.

Online FX options brokers offer traders a selection of tradeable CFD options on currency pairs, stocks, indices, and commodities regulated by Tier 1 regulators such as FCA or CySEC.

Regulated

Forex (Foreign Exchange) is the market where currencies are traded. While this exchange market can be fast-paced and risky, it also helps the world turn. Thanks to Forex, you can buy Etsy products in Canada from Sweden, cars in Sweden, and vacation packages in Brazil from Brazil, all due to this global economy. To successfully navigate forex, you need an expert broker who offers top customer support and provides a safe trading platform.

Regulated brokers are overseen by government bodies within their jurisdiction and must follow stringent guidelines and standards, making any potential problems more straightforward to resolve quickly. Furthermore, being regulated often increases reliability as well as providing competitive spreads and features.

The best forex brokers provide traders with multiple trading options, including CFDs on stocks, commodities, and indices; low commission rates; cutting-edge trading platforms; and free training courses and workshops tailored for newcomers.

US forex traders should select a broker regulated by the Commodity Futures Trading Commission (CFTC) and affiliated with the National Futures Association (NFA). Such brokers must meet stringent standards, including financial stability and transparency, adhere to leverage limits and anti-fraud measures, have physical locations within their country of operation, and offer exceptional customer service.

Safe

Forex trading is one of the world’s most dynamic markets, with billions in transactions flowing 24/7 across borders and oceans. Profits can be quickly made or lost within seconds. Therefore, selecting an appropriate broker to protect your capital is critical. The best brokers offer safe trading environments as well as multiple investment choices; many even provide demo accounts to get you started!

Before choosing a forex options broker, be sure to read its terms and conditions thoroughly. In particular, note any fees associated with non-trading fees, deposit/withdrawal fees, and damaging balance protection policies offered by potential brokers.

An ideal CFD broker allows you to trade various tradable instruments, such as forex pairs, indices, shares, and commodities. Furthermore, it should provide low spreads on its web-based trading platform and offer leverage up to 1:5 on forex pairs.

Most forex brokers do not charge fees when trading options; however, you should be wary of those that do. Unregulated brokers may fail to comply with regulatory standards and could risk insolvency without protection for your funds. To reduce risk and ensure maximum safety, choose an established, regulated forex option broker that is part of a compensation scheme such as FAIR-X(r).

Fast execution

At any given moment, trillions of dollars in currency are flowing around the world, making the foreign exchange market one of the world’s most active and profitable trading venues. Retail traders may find the exchange market extremely technical and risky; however, forex options provide more predictable exposure without needing to purchase currency pairs themselves, helping diversify portfolios.

Forex options are over-the-counter (OTC) contracts that give you exposure to an underlying currency pair with various expiry times and pricing structures available to trade. They tend to be more complex than CFDs, so traders must understand all associated risks and rewards before engaging in selling them.

IG is a premier forex options broker offering an intuitive web-based trading platform with no commission and competitive spreads across an extensive array of currencies. Furthermore, they have developed tools designed to aid traders, such as an economic calendar and educational materials that explain trading concepts.

Trading Forex options should start by searching for brokers with low minimum deposit requirements and fast execution speeds, in addition to making sure the broker offers multiple order types and margin requirements.

Customer service

The best forex options brokers offer an array of trading platforms and tools, support services, training sessions, research studies and analyses, 24/7 customer service via live chat or social media, and free demo accounts to help new traders understand the market before placing their first trades.

Forex options trading should be treated as an intricate instrument with high risks associated with leverage, making the instruments susceptible to rapidly losing money due to leverage. Investors should select only reputable brokers offering low spreads and regulation. Furthermore, investors must understand all risks involved and seek professional advice if required.

In selecting forex options brokers, it’s crucial to compare trading costs such as commissions, spreads, and fees. The ideal forex broker should offer low fees with clear disclosure of charges; additionally, investors must be mindful of any fees that apply for deposits/withdrawals/inactivity charges that could be incurred.

TD Ameritrade stands out among forex brokers as an industry-leading broker with fast response times and knowledgeable assistance, including former floor traders manning its support desk, who are available around the clock for questions regarding markets. Furthermore, clients have access to an advanced proprietary platform as well as extensive research and analysis tools provided by this broker.