Is Intel Stock Undervalued?

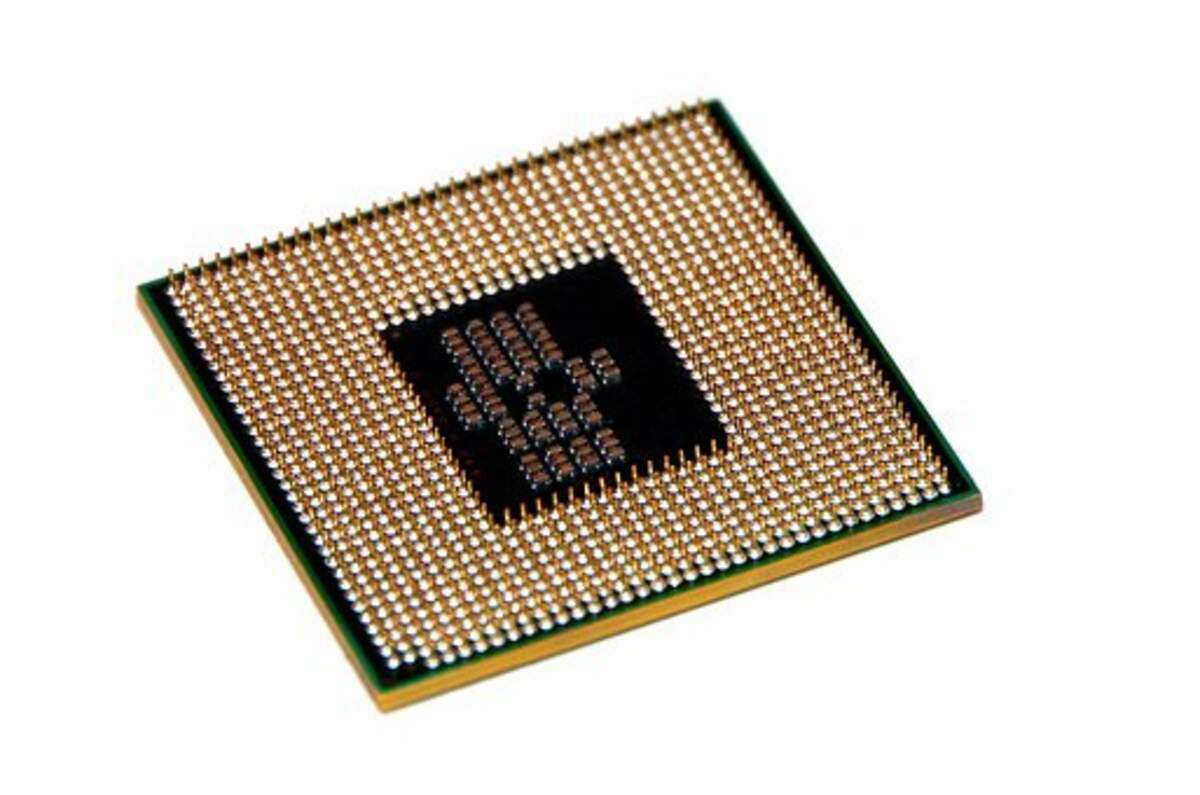

Amongst the world’s leading semiconductor chip manufacturers, Intel Corporation is a technology company with a global presence. It is the largest producer of chips and is also one of the most important developers of the x86 series of instruction sets, which are the standard instructions used by most personal computers.

A pioneer in the semiconductor industry

Founded in 1968, Intel has dominated the computer chip industry for decades. The company was named for Robert Noyce, a Silicon Valley engineer who invented the silicon integrated circuit.

While the semiconductor industry has been cyclical, the downturn has been primarily affecting the consumer, small-medium business, and education markets. A few other notable companies include AMD and NVidia. While Intel has a competitive advantage in the CPU market, it faces threats from the two aforementioned companies.

The company has also been involved in a number of controversial lawsuits involving intellectual property and security. Tariff changes can have a substantial impact on the bottom line of a company. The company has also faced several manufacturing delays.

In a bid to increase margins, Intel has boosted its Mobileye division, which develops self-driving applications for the automotive industry. This division grew by 40% in revenue for 2021.

Moore’s law in the semiconductor space

During its 50-year history, Moore’s law has shaped the semiconductor industry. It has been the driving force of technological change and has helped lower the cost of computing, memory chips, and other digital technology components. However, the exponential benefits of Moore’s law are waning as semiconductor process technologies approach their molecular limits.

Moore’s law was initially described as a doubling of the number of electronic components on an integrated circuit every year. It was later expanded to include a doubling of microprocessor power every 18 months.

Moore’s prediction was based on three years of experience following the debut of the first integrated circuits. However, it didn’t take into account fixed costs for silicon or investment costs.

The speed of technological innovation in the semiconductor space has been influenced by a variety of unique social and economic factors. These factors include hyperconnectivity, artificial intelligence applications, and big data.

Current state-of-the-art chips are at a 10-nanometer scale

Despite being one of the largest chip manufacturers in the world, Intel has fallen behind Samsung in recent years. This isn’t the only reason.

The semiconductor industry has always been working on smaller and smaller microchips. Increasing the number of transistors on a processor can make the chip faster and more energy efficient. In addition, the more transistors a chip has the more options for the processor designer. The demand for this increased performance is growing.

It has also been estimated that the semiconductor industry is investing exponentially more and more money in research and development for newer technologies. While it may seem obvious that the smaller the process, the more advanced the technology, it’s not necessarily true.

A few years ago, GlobalFoundries was expected to deliver 14-nanometer technologies for IBM Power processors. However, it was later announced that GlobalFoundries had shifted its plan to a 7-nanometer process.

Defending sub $25 levels

Despite a couple of recent setbacks, Intel stock is still undervalued. For instance, the P/B ratio is under six. For the past few years, the company has been actively investing in new and next-generation products. This has helped the company stay competitive with its rivals. In fact, it has grown earnings from $1.99 per share in 2017 to $4.86 in 2021.

The company has also recently announced a partnership with Brookfield Infrastructure to help fund the expansion of its campus. The move hasn’t received much attention from investors, however, since the company hasn’t released much information about the deal.

Intel has recently been tasked with a few major projects that should keep it in the headlines for the near future. One project entails the integration of self-driving vehicle technology. Another involves the company’s recent foray into the foundry business. These two initiatives could help the company reclaim its technological throne.

Overextended to the downside

Despite being a leading name in the chip industry for decades, Intel has failed to keep up with technological advances. As a result, the company has fallen behind its rivals. This has led to a major drop in the value of its stock.

Investors have become more interested in firms that make chips for mobile devices and the Internet of Things. But it’s not all doom and gloom. In fact, the semiconductor industry has been experiencing a boom thanks to shortages. And now, Intel is working to re-establish manufacturing facilities in the U.S., which is critical to the stock’s long-term success.

The company recently announced third-quarter 2022 profits that missed analyst estimates. In addition, the company’s profits for the full year were lower than expected.